Did you know that employees with multiple jobs may be able to pay a lower rate of Employees NI if they are already paying their full quota through another employer?

Employees must pay the standard rate of 12% on earnings between £184-£967 per week, thereafter the rate drops to 2% for earnings over this.

While this is very straightforward for employees with a single job, it can be more complicated for agency workers or employees with multiple jobs.

For example, an agency worker on assignment who already earns up to the higher rate threshold in their main job may be put on a D0 tax code by HMRC. This means that they are due to pay 40% tax on all of their additional earnings, plus 12% Employees NI. In this case the agency worker / employee needs to apply to defer paying the standard rate of NI in one or more of their jobs. If successful, HMRC will send the affected employer a deferment certificate and they will be able to start deducting Employees NI at the lower 2% rate. (saving the agency worker 10%)

This will be reviewed yearly by HMRC and they will be due a rebate if they’ve overpaid or be issued a liability if they’ve underpaid.

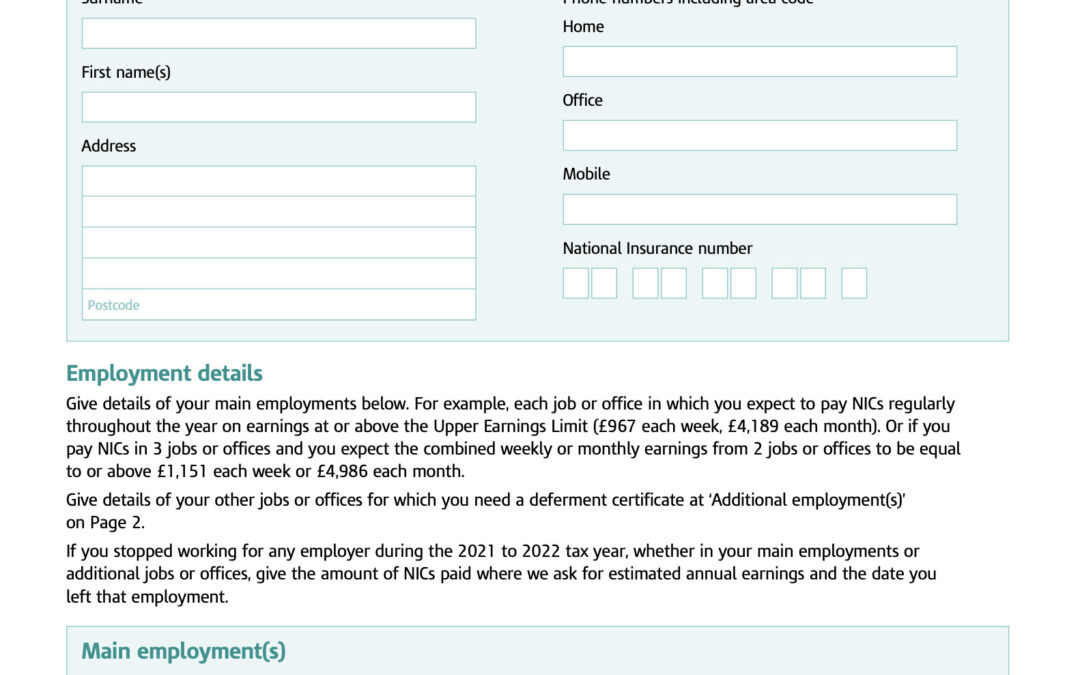

There is a little bit of work for employees to do regarding this, but it can be well worth them doing so.

You can view the details at https://www.gov.uk/defer-national-insurance and the full guidance notes at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/968854/CA72A-Notes-2021.pdf

Recent Comments